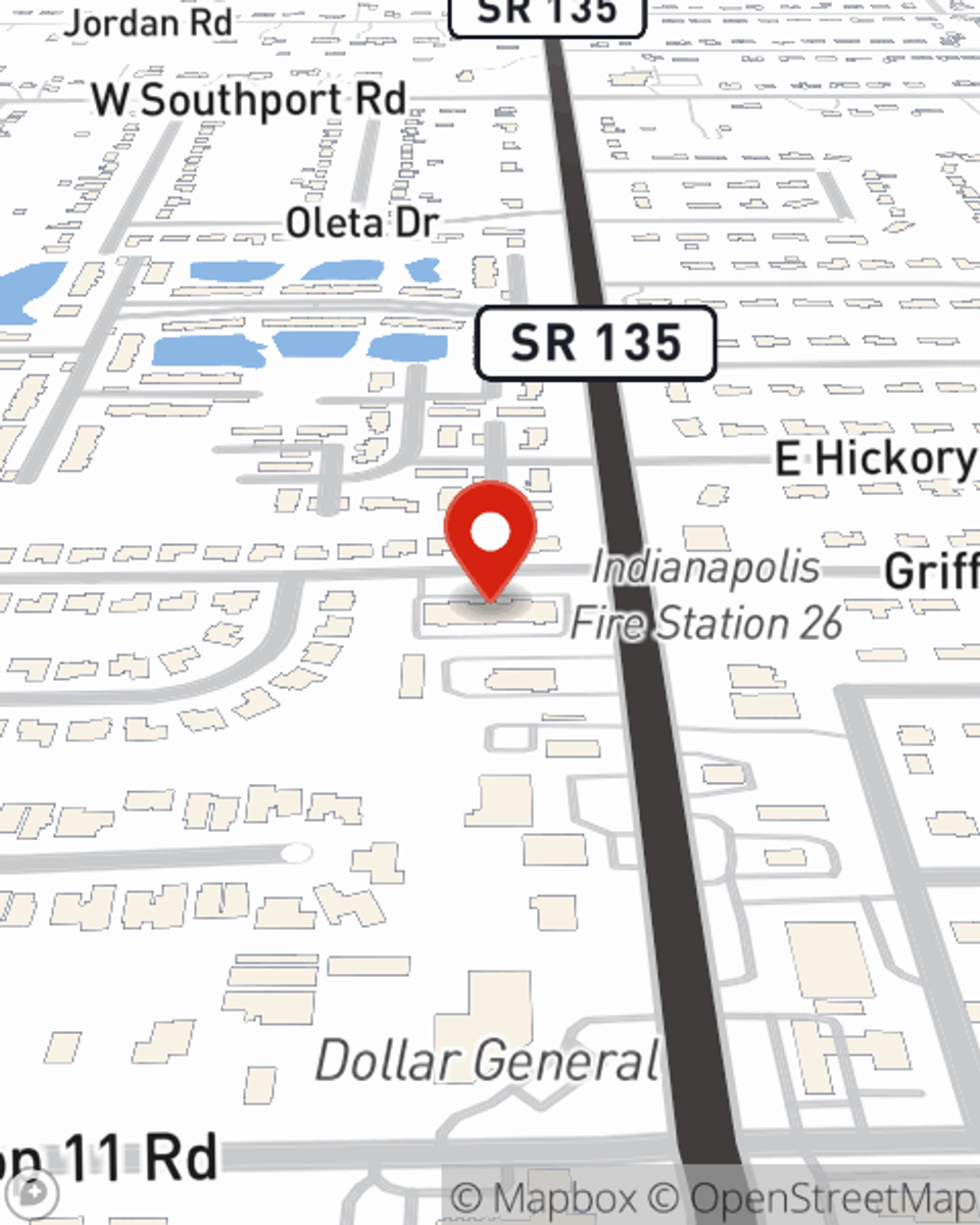

Life Insurance in and around Indianapolis

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

People choose life insurance for various reasons, but the end goal is typically the same: to protect the financial future for your family after you perish.

Get insured for what matters to you

What are you waiting for?

Life Insurance You Can Trust

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you select can be designed to fit your current and future needs. Then you can consider the cost of a policy, which depends on your age and your health status. Other factors that may be considered include lifestyle and personal medical history. State Farm Agent Keith Eberg can walk you through all these options and can help you determine how much coverage is right for you.

To find out your Life insurance options with State Farm, get in touch with Keith Eberg's office today!

Have More Questions About Life Insurance?

Call Keith at (317) 887-1400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Keith Eberg

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.