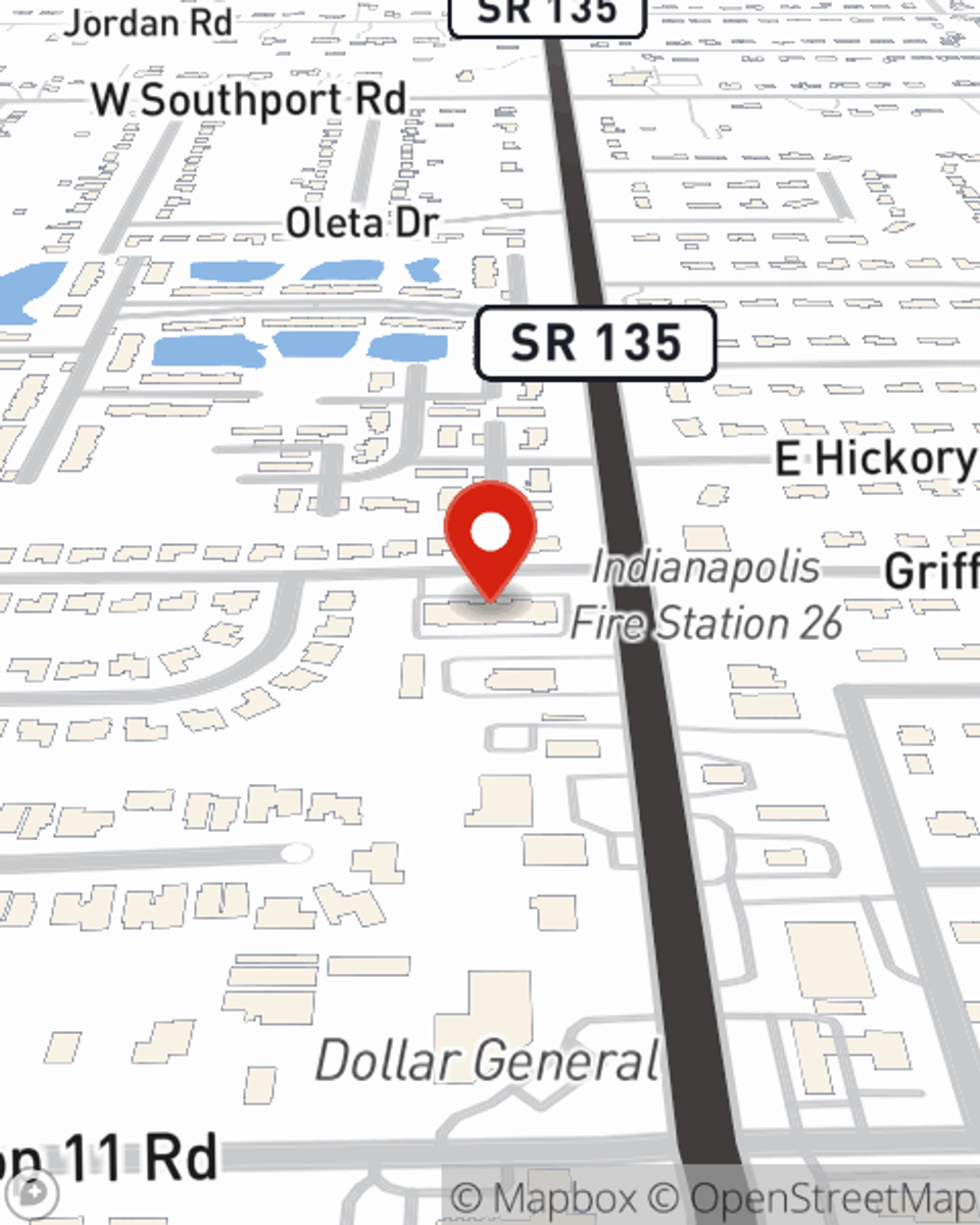

Business Insurance in and around Indianapolis

Researching insurance for your business? Look no further than State Farm agent Keith Eberg!

This small business insurance is not risky

This Coverage Is Worth It.

Small business owners like you have a lot of responsibility. From social media manager to HR supervisor, you do whatever is needed each day to make your business a success. Are you a dentist, a real estate agent or a psychologist? Do you own a beauty salon, a donut shop or a pet store? Whatever you do, State Farm may have small business insurance to cover it.

Researching insurance for your business? Look no further than State Farm agent Keith Eberg!

This small business insurance is not risky

Insurance Designed For Small Business

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for commercial auto, business owners policies, worker’s compensation, and more.

As a small business owner as well, agent Keith Eberg understands that there is a lot on your plate. Get in touch with Keith Eberg today to review your options.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Keith Eberg

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.